Tokenized Private Market Railway™

GazillionX standardizes how private capital is issued, governed, and circulated — issuer-first, asset-backed by design.

We standardize private raises so capital can move faster, safer, and repeatably — at scale.

ABOVE THE FOLD

Private markets move $30T+ globally — but execution is still manual.

That gap is the opportunity.

Private markets remain the only major capital system without a standardized operating rail. Issuance, compliance, governance, ownership, and distributions are still managed through fragmented documents, bespoke workflows, and manual enforcement — not because it’s optimal, but because there hasn’t been a unified alternative.

GazillionX is that alternative: a programmable private-market operating rail where the private placement becomes an executable, auditable process — so capital can move with discipline, consistency, and scale.

Explore the Ecosystem | Request Access

WHY NOW — THE PRESSURE POINT

Private markets didn’t fail.

They hit a limit.

Private markets have survived on manual processes for decades because there was no standardized operating layer. Now deal velocity, global formation, and diligence expectations have outgrown the old model.

-

AI and global formation are increasing issuer velocity faster than legacy workflows can support

-

Investors hesitate less because opportunity is lacking, and more because structure and governance vary deal-to-deal

-

Friction compounds when eligibility, disclosures, reporting, and execution are reinvented every time

-

Infrastructure evolution happens when scale meets operational pressure

-

Private placements exist — but they were never designed to operate digitally as a standardized network

This isn’t a cycle. This is infrastructure catching up to reality.

WHAT IS GAZILLIONX

This is the layer beneath listings. The rail beneath private capital.

This is the layer beneath the listings

GazillionX is a neutral private-market infrastructure layer where issuance, eligibility, governance, ownership, and distributions operate through a shared standard — independent of asset class or geography.

We are issuer-first.

GazillionX is designed to help issuers raise capital on-chain through tokenized private placements (PPMs) — with offerings structured to be asset-backed by design.

The private placement memorandum (PPM) remains the legal vehicle. GazillionX converts that regulated process into a governed workflow that is enforceable and auditable.

-

GazillionX standardizes participation rather than curates opportunities

-

Issuance, compliance, governance rules, and reporting follow a consistent sequence

-

The process becomes the product — reducing reinvention for every deal

-

The model is supported by proprietary architecture and IP strategy

If marketplaces show you deals, a rail standardizes how deals actually work.

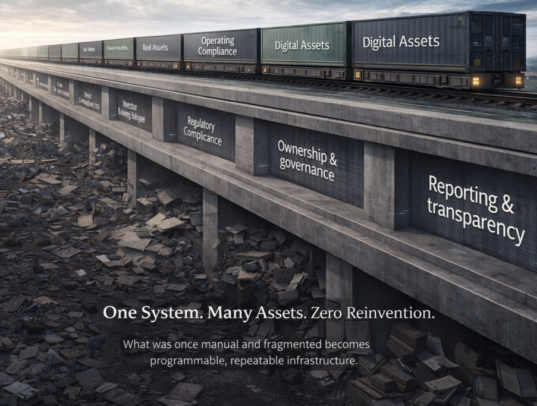

HOW THE PRIVATE MARKET RAIL WORKS

One system. Many assets. Less reinvention.

Private markets become repeatable when the process is standardized.

GazillionX modernizes the private placement lifecycle by turning what was manual and fragmented into a consistent sequence — supporting repeat issuance, clearer governance, and improved comparability across deals.

The Tokenized PPM (Blockchain PPM) becomes the execution rail:

-

PPM terms and requirements are captured into a governed execution flow

-

Eligibility, KYC/AML, and subscription steps are enforced at runtime and auditable

-

Governance, ownership, and reporting logic is structured for repeat execution

-

Distribution and administration workflows are designed to be traceable and consistent

-

Repeat issuance becomes feasible when execution is standardized rather than bespoke

The rail isn’t a “deal feature.” It’s the operating sequence that makes private deals executable at scale.

DE-RISKING THROUGH THE QUAD ASSET FOUNDATION™

Risk isn’t managed later.

It’s underwritten before capital is invited in.

GazillionX is designed so offerings do not begin as naked business risk. Each issuance is structured to be anchored by qualified, diligence-ready assets that strengthen capitalization and improve investor confidence at entry.

Underwriting assets can include: real assets, digital assets, and IP assets.

These assets are integrated into capitalization structures to support stronger offerings and clearer risk posture.

-

Offerings are structured to be asset-anchored by design, not narrative-driven

-

Assets are qualified and integrated as underwriting support (not posted as standalone listings)

-

Asset qualification is designed to be diligence-ready and auditable

-

Income-producing lanes (energy and other cash-flow assets) can serve as early lanes because they are institutionally understood

-

De-risking means capital enters after structure — so investors evaluate governed execution, not uncertainty

THE RAIL VS. THE REST

Standardization without displacement.

Infrastructure doesn’t compete—it underlies.

GazillionX is designed to operate beneath existing market participants. The intent is not to replace venture capital, private equity, asset managers, or platforms, but to standardize how private capital is issued and governed so participation becomes more consistent.

This standardization is anchored in the private placement process—bringing repeatable execution to a system that has historically relied on bespoke workflows.

- The model supports reduced friction across private markets through standardization.

- Interoperability improves when issuance and governance sequences are consistent.

- Existing players can participate without losing identity, strategy, or relevance.

- Standardized process can reduce operational variance deal to deal.

- A defensible rail depends on structure, enforcement logic, and system design—not just software UI.

Platforms compete for attention—rails reduce friction for everyone.

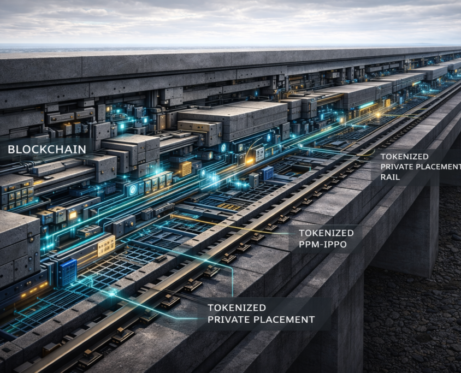

HOW THE RAIL OPERATES

Programmable infrastructure isn’t a feature.

It’s enforcement by design.

GazillionX is designed as a regulated private-market operating layer where defined steps of issuance, eligibility, governance, ownership, and capital circulation can follow standardized rules rather than ad-hoc manual process. The private placement memorandum (PPM) remains the legal vehicle; the rail makes its requirements executable and auditable.

- Blockchain provides a ledgered backbone designed for traceability and auditability.

- Smart-contract logic can automate defined actions where applicable within the framework.

- Tokenization supports structured lifecycle management of private offerings and instruments.

- System rules are intended to apply uniformly—reducing bespoke exceptions.

- The objective is repeatable execution across issuers without rebuilding the workflow each time.

Tokenization isn’t the product—it’s a representation mechanism inside a blockchain-native, policy-governed operating layer governed execution process.

FOR INVESTORS

Confidence at entry. Clarity over time.

Structure is what makes capital move.

GazillionX is designed to give investors a standardized entry point into asset-backed private offerings where underwriting, governance steps, and reporting are structured for consistency. Investors evaluate disciplined execution — not reinvented process.

- Offerings are structured to be asset-anchored by default.

- Eligibility, subscription, and governance steps are designed to be more consistent across deals.

- Standardization improves comparability and reduces “one-off” complexity.

- Reduced friction supports faster decision-making without relaxing diligence.

- System rules are intended to apply uniformly across issuances on the rail.

Investors don’t fund chaos—investors fund structure.

FOR ASSET OWNERS

Assets become anchors, not listings.

Capital efficiency without speculation is the point.

GazillionX is designed so asset owners don’t “post assets.” Assets are qualified and approved to participate as underwriting anchors inside issuer capital formation — supporting stronger offerings and creating ongoing liquidity pathways through structured participation.

- Assets are intended to be qualified and documented to support diligence.

- Approved assets can be matched to issuers to strengthen capitalization frameworks.

- The model is designed to unlock value without requiring speculative trading behavior.

- Asset owners can participate in structured outcomes without becoming the deal sponsor.

- Standardization supports more consistent integration across market cycles.

This isn’t about listing an asset—it’s about making an asset useful inside a bankable structure.

FOR FOUNDERS & BUSINESS OWNERS

Capital after structure.

Not before.

GazillionX helps founders and operators approach capital markets with a structure-first posture — so investors evaluate an asset-underwritten, governed framework, not an unstructured ask. The goal is execution discipline: clear disclosures, eligibility-ready participation, and auditable steps — not a one-off raise.

- Issuers are expected to arrive prepared, documented, and governance-ready.

- Asset anchoring is designed to reduce perceived “naked risk” at entry.

- Standardization supports faster diligence pathways and clearer investor comparability.

- Better structure can improve probability of close and term quality over time.

- Participation is designed to support repeat issuance rather than one-time fundraising.

Fundraising improves when capital meets you after structure—not before it.

SYSTEM ECONOMICS & SELF-SUSTAINING GROWTH

Infrastructure Compounds Through Use.

Not Promotion.

GazillionX is designed as a self-reinforcing infrastructure model where standardized issuance can include defined allocations that support system-level functions—encouraging repeat participation and long-term network strength. The system strengthens through governed execution and repeatable outcomes—not speculation.

- Issuers can allocate defined portions of use of proceeds to system-level support functions within the framework.

- Consistent mechanics support long-term participation without ad-hoc intervention.

- System-level economics are designed for auditability and consistency.

- Repeat offerings can strengthen network trust when outcomes are consistent and governed.

- The model reflects how legacy infrastructure compounds value through participation rather than speculation.

When the system is designed to reinforce itself, growth becomes a byproduct of execution.

PARTNERS, NOT COMPETITORS

Infrastructure scales through adoption.

It becomes more valuable as others use it.

GazillionX is designed to integrate with banks, funds, platforms, asset managers, and institutions that want standardized issuance and governed participation without surrendering their role or strategy. We don’t replace private-market participants—we standardize the execution layer they already depend on.

- Participants can build on the rail rather than rebuild issuance workflows internally.

- Adoption is designed to be additive to existing ecosystems, not disruptive by displacement.

- Standardized mechanics can support interoperability across market participants.

- Value increases as repeatable structures create trust and comparability.

- Infrastructure typically wins when it becomes the shared layer markets rely on.

Markets don’t get replaced—markets get upgraded by infrastructure.

A BANKABLE INFRASTRUCTURE MODEL

Proven by flow — not theory.

Credibility is earned by operation.

GazillionX is designed to validate its infrastructure by using it internally first, before expanding outward. The same issuance sequence, governance steps, and operating controls described on the site are exercised in live operation—so trust is built through execution. GazillionX is the first client on its own rail.

GazillionX is the first issuer on the Railway — proving tokenized capital formation with real assets underneath the company.

- The rail is validated through internal use before external scale.

- Issuance, governance, and capital movement are exercised through the same standardized system.

- Repeatability matters more than demonstrations.

- Third-party diligence is supported when a system is proven by use.

- Bankability is strengthened when outcomes are consistent, traceable, and governed.

Bankable” means the system works before you’re asked to believe it.

A Closed-Loop Capital System

Capital doesn’t reset.

It circulates.

GazillionX is designed as a governed system where participants can evolve through roles over time—issuer, asset owner, investor—supporting repeat participation and reinvestment through the same structured rail. This is a regenerative closed loop: capital formation and capital reuse operating inside governed structure.

- Founders can become issuers within a standardized issuance framework.

- Issuers can accumulate assets that strengthen future capitalization.

- Asset owners can participate in governed structures rather than isolated transactions.

- Investors can redeploy capital through repeat offerings on the same standardized rail.

- The model supports continuity: assets unlock liquidity, and liquidity supports growth within a governed sequence.

A closed loop means capital stays inside governed structure—so progress doesn’t depend on one-time exits.

The GazillionX Ecosystem

Ecosystem Flow

GazillionX operates a governed private-market railway — and Vibes Village is how we solve the #1 problem in private capital: issuer quality and deal flow.

Vibes Village → Issuer Manufacturing (The Pipeline)

Vibes Village is the economic development accelerator that builds and prepares founders and operating businesses into financeable issuers.

It transforms raw potential into decision-ready companies: structured, packaged, documented, and aligned to asset-backed standards — so they can raise capital faster and with less risk.

IOUWealth Fund → Underwriting + Recycling (The Fuel)

IOUWealth is the underwriting and contribution engine that funds formation capacity (operators, build environment, tools, scholarships) and recycles capital to expand throughput.

It lets donors/sponsors underwrite outcomes with discipline, while creating repeatable readiness production at scale.

End Result for GazillionX (Why This Matters)

Together, Vibes Village + IOUWealth solve the two hardest bottlenecks in private markets:

-

Reliable issuer pipeline (built, not hoped for)

-

Underwritten readiness capacity (funded formation, not unpaid coaching)

That means GazillionX can run a repeatable, governed capital system: more qualified issuers, faster raises, lower risk — and revenue at every stage as issuers move through the railway.

.

OIL & GAS BUILT THE PRIVATE PLACEMENT

Oil & gas didn’t adopt private placements.

It institutionalized them.

Oil & gas helped establish the modern private placement discipline: asset-backed capitalization, repeat issuance, risk disclosure, governance expectations, and institutional scrutiny—long before venture capital and modern private equity became dominant.

- The private placement framework was proven through asset-backed issuance at scale.

- Repeat issuance required governance discipline, disclosure rigor, and execution consistency.

- Real estate followed and expanded similar private placement mechanics into income-producing structures.

- Over time, credit, private equity, and venture capital expanded the model into today’s global private markets.

- GazillionX is designed to modernize this existing discipline into a standardized operating rail.

Oil & gas proved the private placement—GazillionX modernizes how it executes.

INTELLECTUAL PROPERTY & SYSTEM PROTECTION

Infrastructure should be defensible.

Not just impressive.

GazillionX is designed with proprietary architecture and process design intended to protect the operating sequence of private-market execution—from issuance and compliance through governance, reporting, and repeat deployment. What we protect is the executable process, not public-facing language.

- IP protection focuses on the process, not superficial platform features.

- The architecture is designed to support repeatable execution across markets and cycles.

- Enforcement logic and sequencing are intended to be system-driven, not discretionary.

- The framework is structured with institutional evaluation and diligence expectations in mind.

- Defensibility strengthens when the “how it works” is embedded into the infrastructure layer.

What’s protected isn’t the interface—it’s the executable process capital runs on.

THE FIRST ISSUER — GazillionX First

No pilots. No exceptions.

The system proves itself by use.

GazillionX is designed to run its own issuance through the same infrastructure offered to the market—exercising the full sequence end-to-end so the rail is validated through live operation rather than abstract demonstration.

- The same standardized issuance workflow is exercised internally first.

- Core mechanics—governance, structure, and lifecycle steps—are proven by execution.

- Internal operation strengthens confidence for external issuers and capital participants.

- Validation is based on traceable flow and documented process.

- The intent is to expand outward only after the system demonstrates repeatable operation.

The first proof of a rail is simple: run real capital through it.

FINAL CLOSE

Private markets do not need another platform.

They need a pathway.

Private markets do not need another platform.

They need a standardized pathway.From Tokenized Private Placement (PPM)

to Initial Private Placement Offering (IPPO™)

to asset-backed private market progression — executed on the Railway.Capital advances along governed rails.

Not a promise of liquidity — a framework for disciplined progression.This is not a promise of liquidity.

It is a framework for progression. It’s regulation executed with discipline—on modern infrastructure.When infrastructure is correct, capital moves forward.

The rail is built.

The system is active.

Private markets can finally evolve.

Contact Us

Get In Touch

Whether you’re exploring, investing, or building — we’re here.

GazillionX Tokenized Private Market Railway™ and its end-to-end issuance, compliance, governance, and capital-circulation processes are protected by proprietary Intellectual Property, including multiple patent-pending and trade-secret architectures.

*This website is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. Investments in GazillionX Inc. are offered only to accredited investors under Regulation D Rule 506(c) or pursuant to other exemptions, and are subject to significant risks. The GZX Token is not offered to the general public and is intended for utility within the GazillionX ecosystem. Any token-related functionality is subject to eligibility, compliance review, and applicable law

GazillionX™, GazillionX Private Market Railway™, Private Market Railway™, Initial Private Placement Offering™ (IPPO™), Tokenized Private Placement™, Tokenized Private Placement Memorandum™ (Tokenized PPM™), Quad Asset Foundation™, Asset-Structured Risk Transfer™, and Capital Intentions™ are proprietary trademarks and Intellectual Property of GazillionX, Inc. All rights reserved.